A government guaranteed saving paying 9.62% interest!

Yes, you read correctly: the annualized interest rate is 9.62%. But strictly speaking, it's not a saving account which you can have with a bank. Instead, it is even better because this saving product is a government issued bond which is guaranteed by US Treasury. Therefore, it literally has zero default risk.

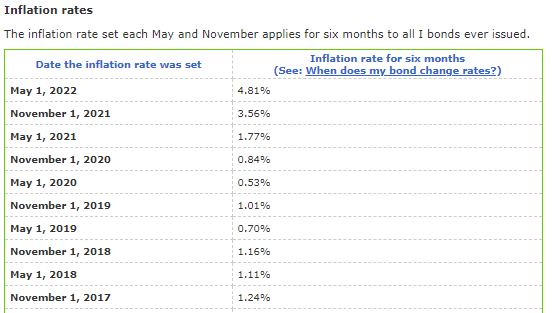

This bond is called i-bond where i stands for inflation. As its name implies, i-bond's interest rate is linked with the current inflation rate. As inflation soars recently, so does i-bond's interest rate. This interest rate is reset every six months on May and November. The table below from the official site treasurydirect.gov shows the historical rates of the i-bond:

Note that the rate quoted above is for 6 months, therefore the corresponding annualized rate is approximately double of that. Before investing in i-bond, it is a good idea to read all its specifications which is available on the website treasurydirect.gov. Some of the most relevant points are listed below:

- Each investor with a unique tax ID (regardless of individual or company) can buy up to $10,000 i-bond per calendar year

- The bond's maturity is 30 years. But an investor can sell it after having holding it for 1 year

- If the actual holding period is less than 5 years upon redemption, the interest accrued during the last 3 months will be forfeited as early redemption penalty

- If the actual holding period exceeds 5 years, then no early redemption penalty applies

Another note is that, though the bond itself has no repayment risk, there is interest risk due to the fact that its rate is reset every six months. For example, if you buy i-bond today, its rate for the first six months is fixed at 9.62% annualized but the rate for the next 6 monts will not be known until 2022/11. However, even if the rate collapses unexpectedly at that time, we can always choose to sell the i-bond a year from today. As a result, our effective annual return will be almost certain higher than that of a typical bank saving account can offer.

An introduction of how to buy US Treasuries, including i-bond, can be found in this article.

2018 FlexibleStudy. All rights reserved.